Not many of us fully consider the total cost of ownership (TCO) when we make our purchasing decisions. We do not consider the lifetime costs of operating a device we purchase, largely because of the complexity of the calculation that can be involved and the difficulty obtaining all the information necessary to complete an accurate calculation. While some manufacturers provide cost of ownership information, it's usually a minimal effort forced upon them in order to comply with government mandated rules.

A new fridge-freezer unit may include a tag that provides an approximation of the annual cost of electricity to operate the device. For example, a 25 cubic foot side-by-side with a sticker price of $1,000 may consume 350 kWh per year. Assuming a cost of $0.10 per kWh it means the annual cost of electricity to power the device is $35. A 30-year-old machine with similar capacity is likely to use around 2,000 kWh per year and cost closer to $200 per year to operate. So, it may be relatively simple for a consumer to determine a saving of $165 per year, and to establish the new refrigerator would pay for itself in 6 years. This is relatively simple because, besides the electricity to power the device, there are no other significant operating costs.

Now think about the much more complex example of a motor vehicle. Regulations require the manufacturer to provide an estimate of the average miles traveled per gallon of gasoline consumed. However, as we all know, this is only one of the costs incurred to operate a motor vehicle. Unfortunately, the average consumer is unlikely to be capable, or sufficiently motivated, to attempt to calculate the total cost of ownership to cover a selection of vehicles they are interested in, and to then select the vehicle that is the best economic decision based on the TCO. Instead, quite often, the decision to buy a motor vehicle (typically the second biggest consumer purchase decision after a house), is based on emotion rather than sticker prices within the buyer's price range.

Factors underlying the TCO on a $35,000 motor vehicle:

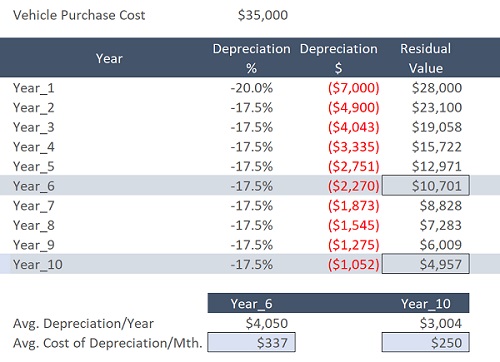

While many of the operating costs are intuitively understood as unavoidable expenses associated with ownership, they are rarely quantified in terms of what they are going to total up to over the lifetime of the vehicle. Furthermore, few are likely to factor in the least well understood cost element of depreciation. Assuming a purchase cost of $35,000, 20% depreciation in year 1 and 17.5% for each of the five following years, then the residual value of a $35,000 purchase at the end of year six is $10,700. This means the average monthly cost of depreciation for 6 years is $337, as much as 65% of the monthly loan repayment on a $30,000 loan repaid over 6 years.

While many of the operating costs are intuitively understood as unavoidable expenses associated with ownership, they are rarely quantified in terms of what they are going to total up to over the lifetime of the vehicle. Furthermore, few are likely to factor in the least well understood cost element of depreciation. Assuming a purchase cost of $35,000, 20% depreciation in year 1 and 17.5% for each of the five following years, then the residual value of a $35,000 purchase at the end of year six is $10,700. This means the average monthly cost of depreciation for 6 years is $337, as much as 65% of the monthly loan repayment on a $30,000 loan repaid over 6 years.

Depreciation Schedule:

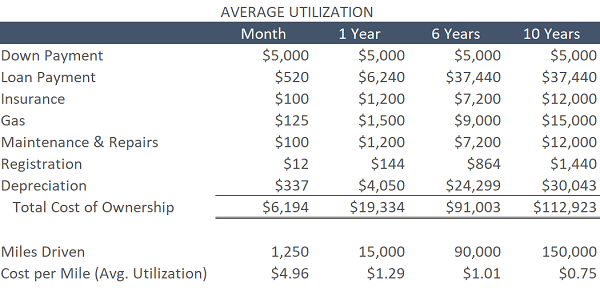

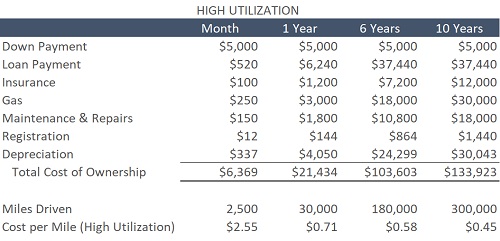

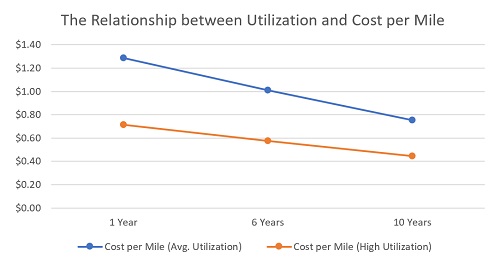

Another factor frequently overlooked in the TCO calculation is the degree of utilization the asset is expected to perform at. The greater the percentage utilization, then the lower the operating cost per unit of measure will be. For example, the total cost of ownership on a per miles driven basis, will be much higher for an owner expecting to drive 15,000 miles (average-utilization) per year, compared to another expecting to drive 30,000 miles (high-utilization) per year.

What does all this mean in terms of the factors a rational consumer should take into account when making a purchase decision?

What does all this mean in terms of the factors a rational consumer should take into account when making a purchase decision?

A rational consumer should take into account each of these important factors that underlie the total cost of ownership. Owning the vehicle for a longer time period reduces the cost of ownership on a per miles driven basis. However, if the consumer expects to drive a lot of miles and to own the vehicle for a longer time frame, it would be wise to research the long-term durability of the vehicle and its reputation under high mileage conditions. Furthermore, in order to protect the residual value and ensure vehicle reliability, the buyer must be prepared for routine maintenance and repair expenses throughout the vehicle's lifetime.

The difference in the total cost of ownership can be substantial on a per miles driven basis. For an "average-utilization" consumer who flips a vehicle every two or three years, the total cost of ownership could be in the region of $1.29 per mile, whereas for the "high-utilization" consumer holding a vehicle for 10 years, the total cost of ownership on a per mile basis, may be as much as 65% lower, in the region of $0.45 per mile driven.

In failing to calculate the total cost of ownership, we fail to recognize the benefits of maximizing the planned lifetime of the asset.

Copier Machines and Total Cost of Ownership

This brings us to office printing devices such as printers and copiers. Whoever would have thought there would be a valid comparison between the total cost of ownership on a motor vehicle and that of a copier machine?

Just scan the list of operating expenses in our examples above. Substitute loan for lease, substitute gas for ink, toner, paper, and other consumables necessary to keep the machine operating and, finally, substitute the total cost of ownership based on miles driven to TCO based on pages printed.

It should be clear how important it is to take the same key metrics used in the motor vehicle example into consideration when deciding about a new printer or copier device. With the number of pages printed steadily declining, making a decision to purchase a machine with a higher duty cycle (print volume capacity) than is needed, means the machine utilization percentage will be lower and the cost per page correspondingly higher than expected. Furthermore, purchasing a device with a higher duty cycle, and possibly including non-essential features, will increase the upfront cost which also directly affects the total cost of ownership. Flipping the machine after 2 or 3 years also contributes negatively to the TCO, just as it does with a motor vehicle.

Historically, copier machines have been sold to businesses under 3- or 4-year lease agreements and the machines are often under-utilized. While the optimal machine may have been selected according to print volume expectations at the time of the sale, almost certainly these expectations are no longer being met. For a business that contracted to a 3- or 4-year deal expecting (for example) $0.01 cost per page on mono and $0.05 on color, a new calculation based on current volumes is likely to turn up significantly higher per page costs.

A significant element of a vehicle purchase decision is emotional. Quite often a consumer will choose to ignore the total cost of ownership on a motor vehicle because, sub-consciously, an emotional decision has already been made to buy that particular motor vehicle even though it may not be the best economic decision. However, the same emotional element should be far less likely to come into play with the purchase of a copier or office printing device. Instead, so long as the relevant information can be provided to the purchaser, then a pure economic decision is more likely to take place that will result in a lower total cost of ownership.

To learn more about the total cost of ownership variations on printers and copiers please check out our TCO calculator. Complete the form below and get free and immediate access.